When you are trying to prepare your house for sale there are a few things I would like to remind you to be aware of. These tips are things sellers normally either forget or do not even know to thing of. 1. Paint. If you can try to repaint your walls a natural color. Buyers do not want to be distracted by the colors of your walls. This also helps the buyer be able to envision their personal belongings in your home. 2. Clean, de-clutter, and depersonalize. You want your home to look as clean as possible when you have potential buyers taking tours of your home. By cleaning and de-cluttering this will make your home look well kept and appleaing.One thing most home owners and even realtors forget to do after cleaning the bathroom is to CLOSE THE TOILET. Leaving this open is not something people want to see in pictures or in their walk through. By depersonalizing your home this will also help with the buyer to be able to envision themselves in your home. This means take down all person pictures, accents, children toys are put away, and pet items are put away. 3. Staging. Keep the decor simple. Again your goal is to help the buyer to be able to envision themselves in your space. make sure you have light bulbs replaced if they needs replaced or even replace them with a brighter light output. Bringing in plants into the space is a good idea too. This will give it a calming natural feel to the space. Make sure you clean and organize your closet spaces as well this will make...

When you are trying to prepare your house for sale there are a few things I would like to remind you to be aware of. These tips are things sellers normally either forget or do not even know to thing of. 1. Paint. If you can try to repaint your walls a natural color. Buyers do not want to be distracted by the colors of your walls. This also helps the buyer be able to envision their personal belongings in your home. 2. Clean, de-clutter, and depersonalize. You want your home to look as clean as possible when you have potential buyers taking tours of your home. By cleaning and de-cluttering this will make your home look well kept and appleaing.One thing most home owners and even realtors forget to do after cleaning the bathroom is to CLOSE THE TOILET. Leaving this open is not something people want to see in pictures or in their walk through. By depersonalizing your home this will also help with the buyer to be able to envision themselves in your home. This means take down all person pictures, accents, children toys are put away, and pet items are put away. 3. Staging. Keep the decor simple. Again your goal is to help the buyer to be able to envision themselves in your space. make sure you have light bulbs replaced if they needs replaced or even replace them with a brighter light output. Bringing in plants into the space is a good idea too. This will give it a calming natural feel to the space. Make sure you clean and organize your closet spaces as well this will make...

First off you should know the difference between a Mortgage Lender vs a Mortgage Broker. A Mortgage Lender is a company. They only get mortgages within their company. For example: Wells Forgo Mortgage, Ruoff Home Mortgage, and Union Saving Bank are Mortgage Lenders. A Mortgage Broker is an individual person. A mortgage broker has multiple sources to get you the best interest rate or loan terms possible. This is a more personable experience. The broker will be dealing with you directly, but he will be handling all the haggling with the Mortgage Companies. Just beware that some brokers have deals made up with certain mortgage companies for a bigger profit. This could make a better deal for them instead of for you. I personally do not have a preference as a realtor on if the buyer uses a Mortgage Lender or a Mortgage Broker. Who ever can offer the buyer the best deals is what it really comes down to. My advice is to shop around. Get advice and references from family members, friends, and online reviews. I would then go and meet the Leander(s) or Broker(s) for a personal interview in order to make the best educated decision. It is important to do as much research as possible before making a decision. Image...

First off you should know the difference between a Mortgage Lender vs a Mortgage Broker. A Mortgage Lender is a company. They only get mortgages within their company. For example: Wells Forgo Mortgage, Ruoff Home Mortgage, and Union Saving Bank are Mortgage Lenders. A Mortgage Broker is an individual person. A mortgage broker has multiple sources to get you the best interest rate or loan terms possible. This is a more personable experience. The broker will be dealing with you directly, but he will be handling all the haggling with the Mortgage Companies. Just beware that some brokers have deals made up with certain mortgage companies for a bigger profit. This could make a better deal for them instead of for you. I personally do not have a preference as a realtor on if the buyer uses a Mortgage Lender or a Mortgage Broker. Who ever can offer the buyer the best deals is what it really comes down to. My advice is to shop around. Get advice and references from family members, friends, and online reviews. I would then go and meet the Leander(s) or Broker(s) for a personal interview in order to make the best educated decision. It is important to do as much research as possible before making a decision. Image...

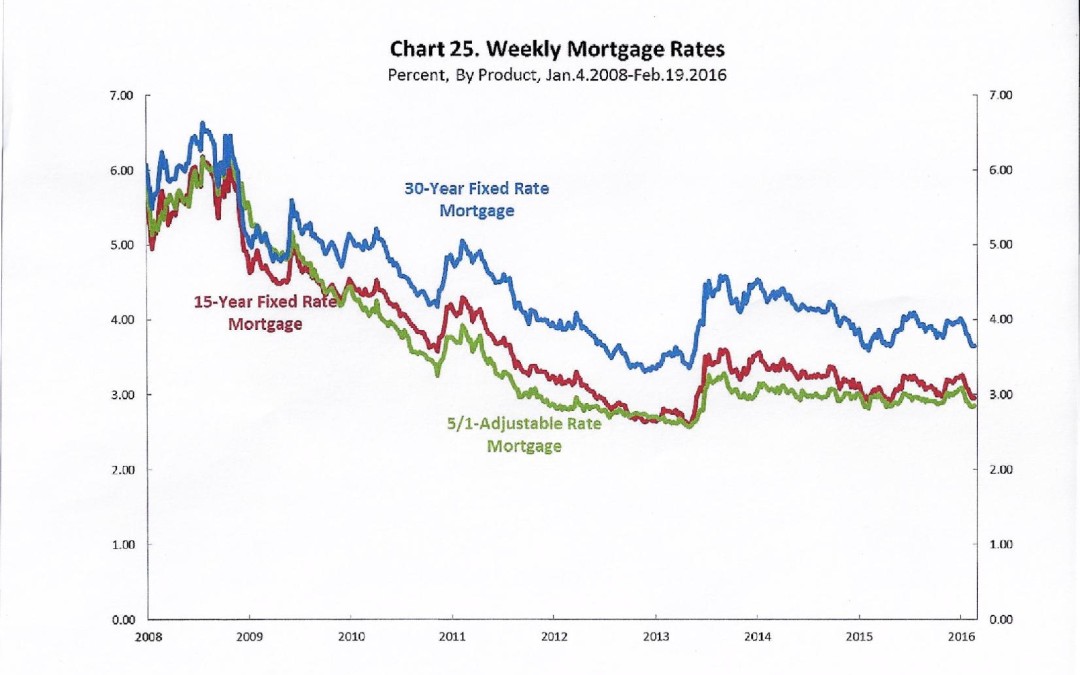

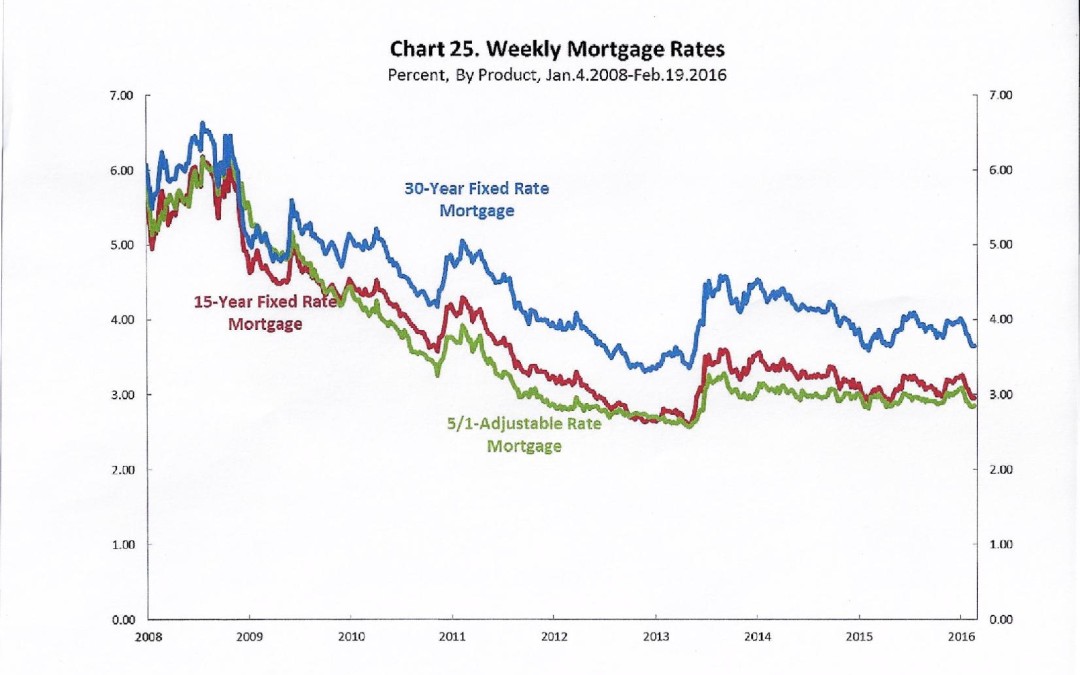

In case you were wondering, here is an 8 year history of mortgage rates....

In case you were wondering, here is an 8 year history of mortgage rates....

Recent Comments